The children's outerwear market represents one of the most fiercely contested categories in the kids fashion industry, with brands competing across multiple dimensions including technical performance, style, value, and sustainability. As manufacturers supplying this competitive segment, we observe the complex factors that make outerwear both challenging and rewarding for brands.

The kids outerwear segment is highly competitive due to its high price points, technical performance requirements, seasonal purchase patterns, brand visibility opportunities, and the convergence of multiple consumer needs in single products. This category demands significant investment in both design innovation and functional performance while offering the potential for strong margins and brand-building impact that justifies the intense competition. Successful outerwear brands must simultaneously address parents' practical concerns, children's style preferences, and retailers' margin requirements.

How Do Price Points and Margin Structures Drive Competition?

The children's outerwear category commands significantly higher price points than other children's apparel segments, attracting both specialized brands and general apparel companies seeking higher margins.

Outerwear represents one of the most expensive items in a child's wardrobe, with quality jackets and coats often costing 3-5 times more than basic clothing items. These elevated price points create attractive margin opportunities that draw multiple competitors into the market. However, the higher stakes also mean that unsold inventory carries greater financial risk, intensifying the competition to accurately predict demand and secure retail placement.

What Price Ranges Characterize Different Market Tiers?

The kids outerwear market segments into distinct price tiers that reflect different value propositions and target demographics. Budget options from supermarkets and value retailers typically range from $25-50, mid-market brands occupy the $50-120 range, while premium technical and designer outerwear can command $120-300+. According to the NPD Group's apparel pricing analysis, the average price for children's outerwear has increased 18% since 2019, outpacing inflation and reflecting consumer willingness to invest in quality. This pricing structure creates competitive pressure at each tier, with brands constantly needing to justify their positioning through features, materials, or brand equity that resonates with their target customers.

How Do Margin Structures Impact Business Strategy?

The attractive margins in children's outerwear support significant investment in marketing, technology, and retail presence that further intensifies competition. With gross margins typically ranging from 50-70% compared to 30-50% for basic apparel, outerwear brands can fund extensive marketing campaigns, technical research, and prime retail real estate. However, these same margin opportunities attract competitors, creating a cycle where brands must continuously innovate to maintain their position. The Harvard Business Review's analysis of premium markets notes that high-margin categories typically experience more intense competition because the potential rewards justify significant competitive investment.

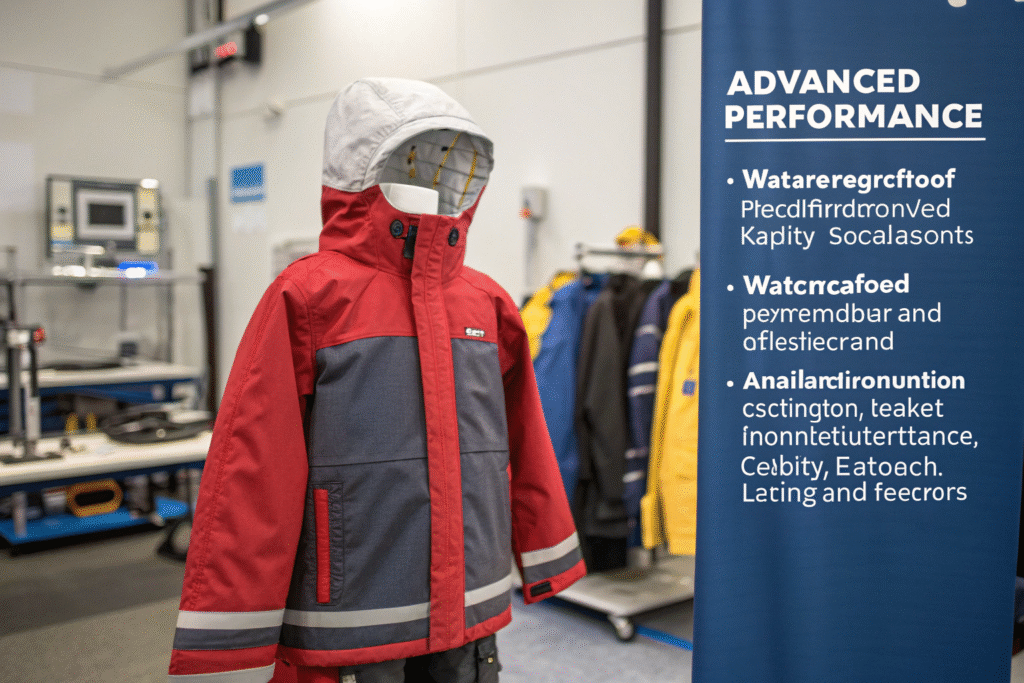

What Technical and Performance Requirements Increase Competitive Barriers?

Children's outerwear must deliver sophisticated performance features while meeting rigorous safety standards, creating significant technical barriers that separate market leaders from followers.

Unlike basic apparel, outerwear requires specialized knowledge of waterproofing technologies, insulation systems, durability standards, and safety considerations specific to children's use. This technical complexity means that successful competitors must invest in research, testing, and specialized manufacturing capabilities that go beyond conventional apparel production.

How Do Performance Standards Differentiate Competitors?

Technical performance metrics like waterproofness (measured in mm), breathability (measured in g/m²/24hrs), and insulation values (clo or TOG) provide objective differentiators that informed parents use to evaluate options. Brands investing in certified technologies like GORE-TEX, PrimaLoft, or proprietary waterproofing systems can command significant price premiums. According to the American Society for Testing and Materials, compliance with specific performance standards has become a key competitive differentiator, particularly in markets with extreme weather conditions where functional performance outweighs stylistic considerations. This technical arms race requires continuous investment that intensifies competition while creating barriers for new entrants.

Why Do Safety Considerations Increase Competitive Complexity?

Children's outerwear must address unique safety considerations including flammability standards, drawstring regulations, and choking hazard prevention that add layers of compliance complexity. The Consumer Product Safety Commission maintains specific regulations for children's outerwear, particularly regarding drawstrings and flammability. These safety requirements necessitate specialized design approaches, additional testing, and potentially higher production costs that brands must balance against performance and style objectives. This regulatory landscape creates competitive advantages for companies with established compliance expertise while presenting significant hurdles for newcomers lacking this specialized knowledge.

How Do Seasonal Patterns and Inventory Risks Intensity Competition?

The highly seasonal nature of outerwear purchasing creates compressed selling windows and significant inventory risks that force brands to compete aggressively for consumer attention and retail space during critical periods.

Unlike year-round basics, outerwear has narrow peak selling seasons that vary by climate region, creating complex production planning and inventory management challenges. This seasonality means that missed opportunities during key selling periods cannot be easily recovered, intensifying competitive pressure to secure consumer mindshare and retail placement.

What Are the Critical Timing Considerations?

The outerwear selling season typically compresses into 8-12 week windows that vary by geographic market, with northern regions concentrating demand in September-November while southern markets may have dual peaks in late fall and winter. According to the National Retail Federation's seasonal analysis, approximately 60% of annual children's outerwear sales occur during the back-to-school and holiday periods. This compressed timeline forces brands to make significant inventory commitments months in advance based on demand predictions, creating substantial financial risk if styles underperform or weather patterns deviate from historical norms. The combination of high product value and short selling windows means competition for consumer attention during these critical periods is particularly intense.

How Does Inventory Risk Shape Competitive Behavior?

The consequences of inventory miscalculation in children's outerwear are more severe than in other apparel categories due to higher product value and limited carryover potential. Unsold outerwear typically requires deeper discounting than basics, and styles may become obsolete due to sizing limitations or evolving performance standards. Research from the Fashion Retail Academy indicates that outerwear markdowns average 45-60% compared to 30-40% for basic apparel, reflecting the higher stakes of inventory management. This risk profile forces brands to compete not just on product features and marketing, but also on supply chain efficiency, demand forecasting accuracy, and inventory management sophistication.

Why Does Outerwear Offer Disproportionate Brand-Building Opportunities?

The visibility, emotional resonance, and practical importance of outerwear create exceptional opportunities for brand building that extend far beyond immediate sales, attracting competitors seeking to establish broader brand equity.

Children's outerwear serves as highly visible brand advertising, with jackets and coats being worn consistently throughout seasons and often representing the most recognizable item in a child's wardrobe. This visibility, combined with the emotional significance of protection from elements, creates powerful brand association opportunities that justify significant competitive investment.

How Does Outerwear Function as Mobile Advertising?

A child's coat or jacket represents one of the most frequently worn and visible items in their wardrobe, creating ongoing brand exposure in schools, playgrounds, and community settings. Unlike other apparel that may be worn intermittently, outerwear is typically used daily throughout the season, with high visibility due to its size and consistent wear. According to the Journal of Consumer Marketing, outerwear delivers 3-5 times more brand impressions than other apparel categories due to its consistent visibility and longer wear period. This mobile advertising effect makes outerwear particularly valuable for brand building, encouraging intense competition for market share.

Why Does Emotional Connection Drive Competitive Intensity?

Outerwear carries emotional significance as protective gear that parents trust to keep their children safe, warm, and dry in challenging conditions. This emotional dimension means purchase decisions involve greater consideration and brand trust than routine apparel purchases. Research from the Journal of Marketing Research indicates that products with strong emotional connections achieve 25% higher brand loyalty and 30% higher lifetime customer value. The combination of functional importance and emotional resonance makes outerwear a strategic category for building long-term customer relationships, justifying the intense competition among brands seeking to establish these connections.

Conclusion

The children's outerwear segment remains intensely competitive due to the convergence of attractive margins, technical complexity, seasonal pressure, and exceptional brand-building potential. This combination of factors attracts diverse competitors ranging from specialized technical brands to fast-fashion retailers and value-focused supermarkets, each leveraging different advantages to capture market share. Success in this challenging category requires balancing technical performance with appealing design, strategic pricing with inventory management, and brand building with retail execution.

The competitive intensity shows no signs of diminishing as consumer expectations continue rising regarding sustainability, performance, and value. If you're entering or expanding in the children's outerwear market and need manufacturing expertise with the technical capabilities and quality standards this demanding category requires, contact our Business Director, Elaine, at elaine@fumaoclothing.com. Let's discuss how we can help you develop outerwear that stands out in this competitive landscape while meeting the practical needs of children and the value expectations of parents.