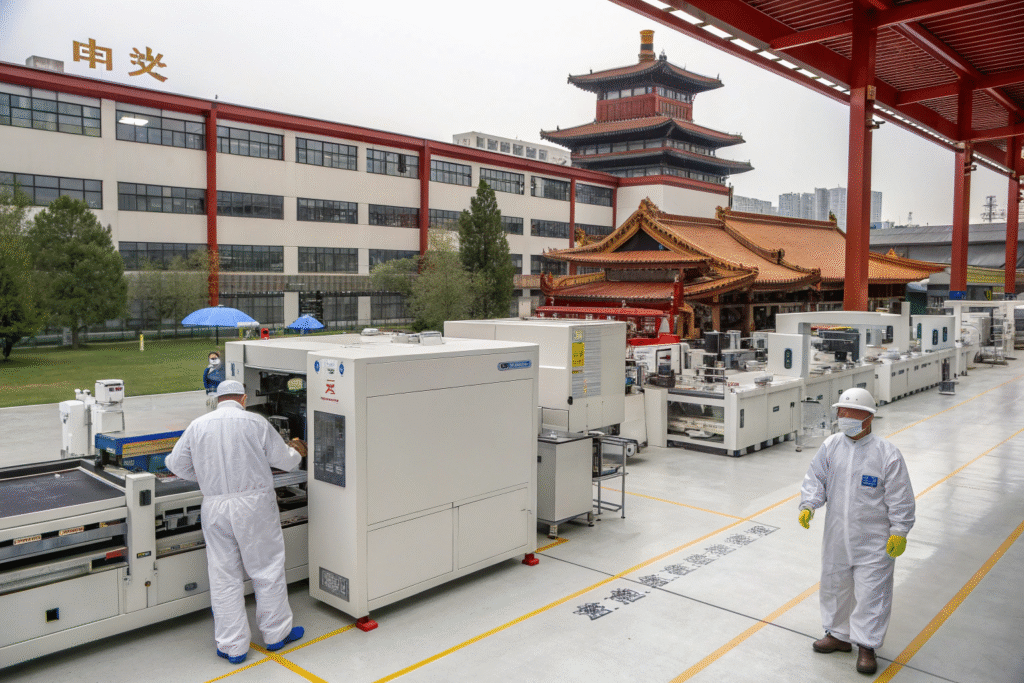

The landscape of American children's wear sourcing has undergone a significant transformation, with China emerging as a dominant manufacturing partner despite geopolitical tensions and rising labor costs. This trend reflects complex calculations that go beyond simple cost considerations to encompass production capabilities, supply chain resilience, and evolving consumer expectations.

American brands are increasingly sourcing kids wear from China because of sophisticated manufacturing ecosystems, competitive pricing despite wage increases, reliable quality control systems, comprehensive supply chain integration, and the ability to handle complex safety and compliance requirements efficiently. This shift represents a strategic choice rather than just a cost-driven decision.

While Southeast Asian alternatives have gained attention, China's established infrastructure, technical expertise, and scale continue to offer compelling advantages for children's wear production specifically. The country has evolved from a basic manufacturing center to a sophisticated production partner capable of meeting the exacting standards required for the American children's wear market. Let's examine the specific factors driving this sourcing trend.

How has Chinese manufacturing evolved beyond low-cost production?

The perception of Chinese manufacturing as primarily focused on low-cost, basic production fails to capture the significant evolution that has occurred over the past decade. Chinese factories have invested heavily in upgrading capabilities specifically for demanding markets like children's wear.

Chinese manufacturing has evolved beyond low-cost production through substantial investments in automation and technology, development of specialized expertise in complex categories, implementation of rigorous quality management systems, and adoption of sustainable manufacturing practices. This transformation has positioned China as a value-added partner rather than just a cost-saving option.

What technical capabilities distinguish Chinese children's wear production?

Chinese manufacturers have developed specialized expertise in children's wear-specific requirements like intricate embroidery, specialized printing techniques, complex appliqué work, and technical construction details like Germanium-sewn seams for durability. Many factories now operate dedicated children's wear divisions with pattern makers who understand children's proportions and safety requirements. This specialization means they can execute sophisticated designs while maintaining the safety standards required for the American market. The depth of this expertise is difficult to replicate in newer manufacturing regions.

How have quality systems improved to meet American standards?

Leading Chinese manufacturers have implemented comprehensive quality management systems that often exceed basic requirements, with dedicated teams focused on American safety standards like CPSIA compliance. Many factories maintain in-house testing laboratories for colorfastness, fabric strength, and chemical compliance, allowing issues to be identified and addressed before production. Third-party audit compliance has become standard, with facilities regularly undergoing inspections from organizations like ITS, BV, and SGS. This focus on quality systems provides American brands with confidence in consistent execution across production runs.

Why does supply chain integration provide competitive advantages?

China's comprehensive textile ecosystem creates significant efficiencies that extend beyond factory walls to encompass the entire production process from raw material to finished product.

Supply chain integration provides competitive advantages by reducing lead times through geographic concentration, enabling better cost control through vertical operations, facilitating material innovation through mill relationships, and simplifying logistics through established export infrastructure. This ecosystem approach is particularly valuable for children's wear with its complex material requirements.

How does material access impact children's wear production?

China's dominance in textile production means manufacturers have immediate access to an unparalleled variety of fabrics, trims, and components specifically developed for children's wear. This includes OEKO-TEX certified cottons, performance fabrics with moisture-wicking properties, and safety-compliant components like breakaway drawstrings and non-toxic dyes. The ability to source these materials locally with minimal logistics complexity allows for faster sampling and production while maintaining cost control. This material ecosystem is particularly valuable for American brands developing technical children's wear with specific performance requirements.

What logistics efficiencies support the American market?

China's established infrastructure for international shipping to the United States, including major ports, established freight relationships, and expertise in customs documentation, creates significant advantages. The predictability of shipping timelines from China, despite global disruptions, remains a key factor in its manufacturing appeal. Additionally, consolidated shipping options allow smaller American brands to access ocean freight economics that would be unavailable from less established shipping routes. This logistics reliability is crucial for children's wear with its seasonal timing requirements and inventory planning challenges.

How do Chinese manufacturers address safety and compliance concerns?

Children's wear represents one of the most regulated product categories in the American market, and Chinese manufacturers have developed specific expertise in navigating these requirements efficiently.

Chinese manufacturers address safety and compliance concerns through investments in testing infrastructure, development of specialized compliance teams, implementation of documentation systems, and establishment of traceability protocols. This focus on compliance has been essential for maintaining access to the American market.

What specific compliance capabilities have been developed?

Leading Chinese manufacturers maintain comprehensive compliance departments with staff dedicated to understanding and implementing American safety standards like CPSIA requirements for lead and phthalate content, flammability standards for sleepwear, and labeling requirements. Many have established relationships with American compliance consultants and testing laboratories, creating efficient pathways for certification. This expertise is particularly valuable for American brands that may lack internal compliance resources, as manufacturers can guide them through the complex regulatory landscape.

How has transparency improved in response to market demands?

In response to American brand requirements, Chinese manufacturers have significantly improved supply chain transparency, with many implementing tracking systems that provide visibility into material origins and production processes. This transparency is particularly important for children's wear where brands must verify safety claims and ethical manufacturing practices. Many factories now conduct regular social compliance audits and maintain documentation for material certifications, providing American brands with the evidence needed to support their marketing claims and regulatory compliance.

What cost considerations continue to favor Chinese sourcing?

While Chinese labor costs have increased significantly, total cost calculations often still favor Chinese manufacturing when factoring in productivity, infrastructure efficiencies, and scale economies.

Cost considerations continue to favor Chinese sourcing because of high labor productivity, infrastructure efficiencies that reduce indirect costs, scale economies that offset wage increases, and total cost calculations that encompass more than just labor rates. These factors maintain China's competitiveness despite rising wages.

How does productivity offset higher labor costs?

Chinese factories have achieved remarkable productivity gains through automation, workflow optimization, and worker training that often offset their higher wage rates compared to Southeast Asian alternatives. Specialized equipment for specific tasks like automated cutting, computerized embroidery, and advanced sewing machines allows fewer workers to produce more output. Additionally, the skilled workforce can execute complex operations more efficiently, reducing rework and improving quality. When American brands calculate total cost, these productivity factors often make Chinese manufacturing more economical than initial labor rate comparisons might suggest.

What role do indirect costs play in sourcing decisions?

The total cost of manufacturing encompasses many factors beyond direct labor, including materials, overhead, transportation, and import duties. China's integrated supply chain often provides better material pricing, while its established infrastructure reduces overhead costs like reliable electricity and transportation. Additionally, the predictability of Chinese production—with established timelines and reliable quality—reduces the hidden costs of delays, rework, and communication challenges that can plague manufacturing in less developed regions. For American children's wear brands, these predictability benefits often outweigh modest labor cost advantages elsewhere.

How are Chinese manufacturers adapting to American brand expectations?

The relationship between American brands and Chinese manufacturers has evolved from transactional sourcing to strategic partnership, with manufacturers making significant adaptations to meet specific American market requirements.

Chinese manufacturers are adapting to American brand expectations by developing design and development capabilities, implementing flexible production models, enhancing communication and project management, and adopting sustainability initiatives. These adaptations reflect the evolving nature of global supply chains.

What value-added services are manufacturers now providing?

Progressive Chinese manufacturers now offer comprehensive services that extend beyond basic production to include design assistance, fabric development, prototyping, and even inventory management. This vertical integration allows American brands to streamline their operations by working with a single partner for multiple aspects of product development. For children's wear specifically, manufacturers have developed expertise in creating tech packs that address American safety standards and sizing expectations. These value-added services reduce the internal resources required by American brands while accelerating time to market.

How are manufacturers addressing sustainability concerns?

In response to American consumer demand, Chinese manufacturers have made significant investments in sustainable practices, including water treatment systems, energy efficiency improvements, and recycling initiatives. Many now offer GOTS-certified organic cotton, recycled materials, and environmentally friendly dyeing processes. This sustainability focus aligns with the values of many American children's wear brands and their customers. Additionally, manufacturers are implementing social compliance programs that address ethical concerns, with many facilities achieving certifications like WRAP or BSCI that provide assurance to American brands and consumers.

Conclusion

American brands continue to source children's wear from China because of a compelling combination of manufacturing sophistication, supply chain integration, compliance expertise, and evolving partnership models. While production costs have increased, the value proposition has simultaneously evolved from basic cost savings to encompass quality, reliability, and comprehensive service offerings.

The most successful sourcing relationships have transitioned from transactional arrangements to strategic partnerships where Chinese manufacturers function as extensions of American brands' product development teams. This collaboration allows brands to leverage Chinese manufacturing capabilities while maintaining their brand identity and market positioning.

As the global sourcing landscape continues to evolve, China's established infrastructure, technical expertise, and adaptive capabilities suggest it will remain a significant player in American children's wear sourcing, albeit in an increasingly sophisticated and value-added role.

Ready to explore Chinese manufacturing for your children's wear line? Our expertise includes connecting American brands with qualified Chinese manufacturers who understand the specific requirements of the US market. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss how we can help you develop an effective China sourcing strategy.