For any children's clothing brand looking to expand, Europe presents a tantalizing yet complex mosaic of markets. It's a common misstep to view "Europe" as a single, homogeneous entity. Having supplied brands from Stockholm to Barcelona for years at Fumao Clothing, I can tell you that a collection that flies off the shelves in Milan might sit untouched in Munich. Success requires moving beyond translation of language to a true translation of taste, culture, and daily life. The differences are not random; they are deeply rooted in climate, cultural values, parenting philosophies, and aesthetic traditions.

The key differences in kids' wear preferences across Europe revolve around distinct regional aesthetics (Nordic minimalism vs. Mediterranean color), varying prioritization of functionality and formality, divergent approaches to seasonality and layering due to climate, and nuanced interpretations of sustainability and quality, all of which demand a tailored, market-by-market strategy rather than a one-size-fits-all approach.

Understanding these nuances is the difference between a brand that is tolerated and one that is embraced. It's about recognizing that a French parent's definition of "chic" differs from a Dutch parent's idea of "practical," and both are valid. Let's navigate the continent's key style regions to build a strategic framework for your European expansion.

1. How Do Aesthetic and Style Philosophies Diverge?

The most visible differences are in the overarching aesthetic preferences, which can be broadly categorized into regional style philosophies.

Northern Europe (Scandinavia: Sweden, Denmark, Norway, Finland) & Benelux (Netherlands): The dominant aesthetic is functional minimalism. Think clean lines, uncluttered designs, and a restrained, sophisticated color palette dominated by neutrals—black, white, grey, oatmeal, and earthy tones like moss green and rust. The focus is on high-quality basics, clever layering pieces, and gender-neutral designs. Logos are small or absent; the appeal is in the cut, fabric, and subtle detail. The look is often described as "practical chic" – clothing that is beautiful but never at the expense of functionality for active, outdoor-oriented lifestyles.

Southern Europe (Italy, Spain, France, Portugal, Greece): Here, the aesthetic leans towards elegant expressionism. There is a greater embrace of color, pattern, and decorative details. Fit is often more tailored, even for children. You'll see more traditional "dress-up" pieces, sophisticated tailoring in blazers and coats, and a focus on looking "put together." In France and Italy specifically, there is a notable appreciation for heritage brands, timeless pieces, and an overall "mini-adult" sensibility that values style and presentation highly. The Mediterranean lifestyle influences brighter colors and playful prints, but often executed with a refined eye.

United Kingdom & Ireland: The UK market sits somewhat in between, with its own strong identity. It blends preppy, classic influences (think well-cut chinos, polo shirts, tartan, and fairisle knits) with a heavy dose of high-street trend-driven fashion. The UK is highly receptive to graphic tees, licensed characters (from British TV and literature), and fast-fashion trends, but also maintains a strong segment for quality, traditional brands.

Why is Understanding "Gender-Neutral" Nuances Important?

The concept of gender-neutral clothing is embraced across Europe, but its interpretation varies. In Scandinavia, it's a deeply ingrained norm focused on practicality and equality, resulting in truly unisex palettes and silhouettes. In Southern Europe, while evolving, there is still a stronger tradition of gendered dressing, especially for formal or special occasions. A brand's approach to this must be calibrated; a fully unisex collection might be a signature in the North but may need complementary gendered options in the South.

How Do Local Brands and "Made In" Perceptions Influence Preferences?

Many European consumers have strong loyalty to local or regional brands that reflect their aesthetic and quality standards. Furthermore, "Made in Italy" or "Made in France" carries a premium connotation of style and quality, while "Made in Germany" or "Made in Scandinavia" signals durability and engineering. As an external brand, understanding these perceptions helps you position your product appropriately—emphasizing superior fabric or construction in the North, and design flair or craftsmanship in the South.

2. How Do Climate and Lifestyle Dictate Functional Needs?

Europe's diverse geography creates vastly different daily realities for children, which directly shapes clothing requirements.

Climate Dictates Fabric, Weight, and Layering:

- Nordic/Baltic Regions: Long, harsh winters demand high-performance outerwear. Parents invest in serious technical jackets, snowsuits, and baselayers made from wool (like merino) or high-tech synthetics. The concept of friluftsliv (open-air life) means clothing must be truly weatherproof and durable for outdoor play in all conditions. Summer items are still often in mid-weights.

- Mediterranean Regions: Mild, wet winters and hot, dry summers call for year-round versatility. Winter coats are more about style and wind/rain resistance than extreme insulation. Summer wardrobes require lightweight, breathable fabrics like linen, light cotton, and items with UPF protection. Sun hats and swimwear are key categories.

- Central/Western Europe (Germany, France, Benelux): Experience variable, transitional weather. The emphasis is on smart layering systems. Items like gilets (puffer vests), mid-weight knits, and versatile jackets that can handle a cool morning and a warm afternoon are essential.

Lifestyle Influences Activity-Specific Clothing:

- Urban vs. Rural: In dense cities, kids' wear might prioritize style and easy care for public transport and café culture. In rural areas, durability and mud-resistance are paramount.

- School Uniforms: The UK, Ireland, and parts of Southern Europe (e.g., private schools in Spain) have strong school uniform cultures, affecting the everyday wardrobe and creating a parallel market for uniform-compliant items.

What is the Role of Bicycle Culture in Northern Europe?

In countries like the Netherlands and Denmark, bicycles are a primary mode of family transport. This creates specific demand: reflective details for safety, rainproof over-trousers and coats, and clothing that allows for freedom of movement while seated. Ignoring this practical need is a missed opportunity in these markets.

How Does the "Outdoor Kindergarten" Philosophy Impact Demand?

Prevalent in Germany and Scandinavia, this philosophy sees children playing outside in almost all weather. This drives demand for extremely durable, waterproof, and easy-to-clean playwear—think robust overalls, rubber boots, and functional layers that can get dirty without concern. The clothing is treated as "gear," not just fashion.

3. What Are the Critical Compliance and Sizing Differences?

Navigating Europe isn't just about style; it's about navigating different rulebooks. Safety standards and sizing systems are not fully harmonized.

Safety and Compliance Nuances: While the EU's General Product Safety Regulation (GPSR) and specific standards like EN 14682 (cords and drawstrings) provide a baseline, national vigilance and interpretation can vary. Certain countries may have additional labeling requirements or be particularly strict on chemical compliance (e.g., the Nordic Swan Ecolabel is highly respected in Scandinavia). Germany, through organizations like TÜV, is known for rigorous testing. Your technical files and Declaration of Conformity must be impeccable, and using recognized certifications like OEKO-TEX® Standard 100 is a strong asset across the board.

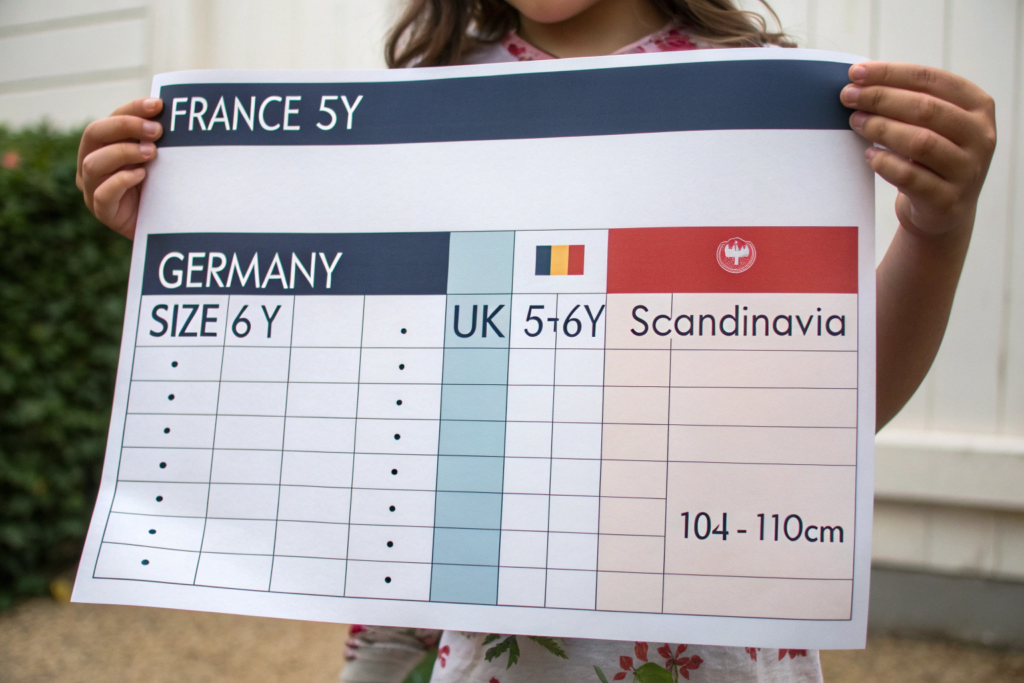

The Sizing Maze: This is a major operational hurdle. There is no single "European size."

- FR/IT/ES Sizing: Runs smaller and slimmer. A French size 6Y is not equivalent to a German size 6Y.

- DE/NL/UK Sizing: Tends to run slightly larger and more generous in cut.

- Scandinavian Sizing: Often aligns with height in centimeters (e.g., 104, 116) and is relatively true to size.

- Age Labeling: Some markets prefer age labeling (3Y, 5Y), while others prefer height-based labeling (92cm, 104cm). A brand must decide on a primary system and provide a clear, visually accessible conversion chart for each market on its website and hangtags.

How Should Brands Handle Care Labeling and Language?

EU law requires care instructions in the language(s) of the country where the product is sold. For a pan-European collection, this often means multi-lingual care labels or a standardized symbol system supplemented by country-specific tags or online information. Getting this wrong can lead to products being pulled from shelves.

Why is "Seasonality" a Calendar Challenge?

Europe's buying seasons are not aligned. When it's Fall/Winter buying in the UK (for August delivery), Southern Europe is still in peak Summer and buying for Resort. Furthermore, school holiday periods vary, affecting retail peaks. A brand must have a clear seasonal calendar and collection flow that serves wholesale partners in different zones, potentially offering "transitional" or "weighted" collections that work across climates.

4. How Do Retail Landscapes and Consumer Values Vary?

Finally, how and where parents shop differs significantly, influenced by both retail structures and underlying consumer values.

Retail Channel Preferences:

- Southern Europe: A stronger culture of independent boutiques and local children's shops. Building relationships with these curated retailers is key.

- Northern & Western Europe: Higher penetration of large department stores, specialist chain stores (e.g., Prenatal in Italy, Zalando online across DACH), and a very advanced direct-to-consumer (DTC) e-commerce culture, especially in the UK and Germany.

- Marketplaces: Amazon is dominant in Germany and the UK, while other local platforms may be stronger elsewhere.

Consumer Values and Purchase Drivers:

- Sustainability: This is a universal trend, but the emphasis varies. In the North, it's a non-negotiable core value focused on material traceability, circularity, and durability. In the South, it may be more weighted towards natural materials (cotton, wool) and artisanal quality.

- Value Perception: In price-conscious markets like Germany, explicit value-for-money and durability are crucial. In Italy or France, perceived quality, brand heritage, and aesthetic appeal can justify a higher price point.

- Digital Engagement: Northern European consumers are highly digitally savvy and trust online reviews. Southern European consumers may still place higher value on tactile, in-store experiences but are rapidly catching up online.

![]()

How to Approach Marketing and Brand Storytelling?

Your brand narrative must resonate locally. In Scandinavia, highlight functionality, ethical production, and minimalist design. In Italy, focus on craftsmanship, fabric quality, and elegant design. In Germany, emphasize product testing, safety, and practical features. A one-note global campaign will be less effective than locally nuanced storytelling.

What is the Strategic Takeaway for Market Entry?

The smart approach is a "glocal" strategy. Develop a strong, coherent core collection that embodies your brand DNA. Then, create regional edits or capsules for key markets. This might mean offering a capsule in richer colors for Spain, adding more technical outerwear for the Nordics, or ensuring your core basics align with the minimalist palette of the Netherlands. Partner with sales agents or distributors who have deep local knowledge of retailers, media, and consumer behavior.

Conclusion

Understanding kids' wear preferences across Europe is an exercise in cultural intelligence. It requires moving beyond superficial assumptions to appreciate the deep-seated connections between climate, culture, and clothing. Success lies in recognizing that Europe is a portfolio of distinct markets, each requiring a tailored blend of your brand's identity and their local expectations.

The brands that thrive are those that do their homework—respecting sizing systems, complying with nuanced regulations, adapting aesthetics without diluting their core, and speaking to parents in a language that goes beyond words to encompass values, lifestyle, and aspiration. It's a complex challenge, but for those who navigate it thoughtfully, the reward is access to one of the world's most sophisticated and valuable children's fashion markets.

Ready to develop a European collection strategy that resonates market-by-market? Partner with a manufacturer experienced in serving diverse European clients. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss how Shanghai Fumao can help you adapt your designs and production for a successful European launch.