Shipping children's clothing to the United States involves navigating complex logistics decisions that impact costs, delivery times, customs clearance, and ultimately customer satisfaction. Choosing the right shipping method requires balancing speed, cost, reliability, and compliance with increasingly stringent US import regulations, particularly for children's products subject to strict safety standards.

The best ways to ship kids clothing to the USA include air express for small urgent orders, sea freight for volume shipments, consolidated shipping for cost efficiency, and hybrid solutions that balance speed and economy, with the specific optimal choice depending on order volume, timeline, and compliance requirements. Each method offers distinct advantages for different business scenarios.

The US market presents unique challenges for children's clothing importers, from Customs and Border Protection (CBP) documentation requirements to Consumer Product Safety Commission (CPSC) compliance verification. Understanding these regulatory frameworks is as important as selecting the right transportation method. Let's explore the specific shipping strategies that deliver children's clothing efficiently while maintaining compliance and cost control.

How does air shipping serve urgent and smaller shipments?

Air freight provides the fastest transit times for children's clothing shipments, making it ideal for time-sensitive orders, small batches, and seasonal inventory that must reach retailers quickly. While premium-priced, air shipping offers advantages that sometimes justify the higher cost.

Air shipping serves urgent and smaller shipments through rapid transit times of 3-10 days, more frequent departures that provide flexibility, lower inventory carrying costs due to faster turnaround, and reduced risk of missing key selling seasons. These benefits often outweigh the higher per-unit cost for time-sensitive merchandise.

When does air express make financial sense for children's wear?

Air express services like DHL, FedEx, and UPS become financially viable when shipping samples, small batches under 50kg, or high-value items where speed to market justifies the premium. For children's clothing brands launching new collections or fulfilling urgent reorders, the revenue protection of having inventory available during peak selling periods often exceeds the additional shipping costs. Additionally, the integrated customs clearance services offered by major express carriers simplify the complex documentation required for children's products entering the US market.

How can air cargo optimize larger urgent shipments?

For shipments between 100kg and 500kg, consolidated air cargo through freight forwarders often provides better rates than integrated express carriers while maintaining reasonable 5-10 day transit times. This approach works well for seasonal launches where getting initial inventory to market quickly supports marketing efforts, with follow-up volume shipments arriving by sea. Many children's clothing brands use this hybrid approach, air shipping early quantities to support retail launches while the bulk inventory follows via ocean transport at significantly lower cost.

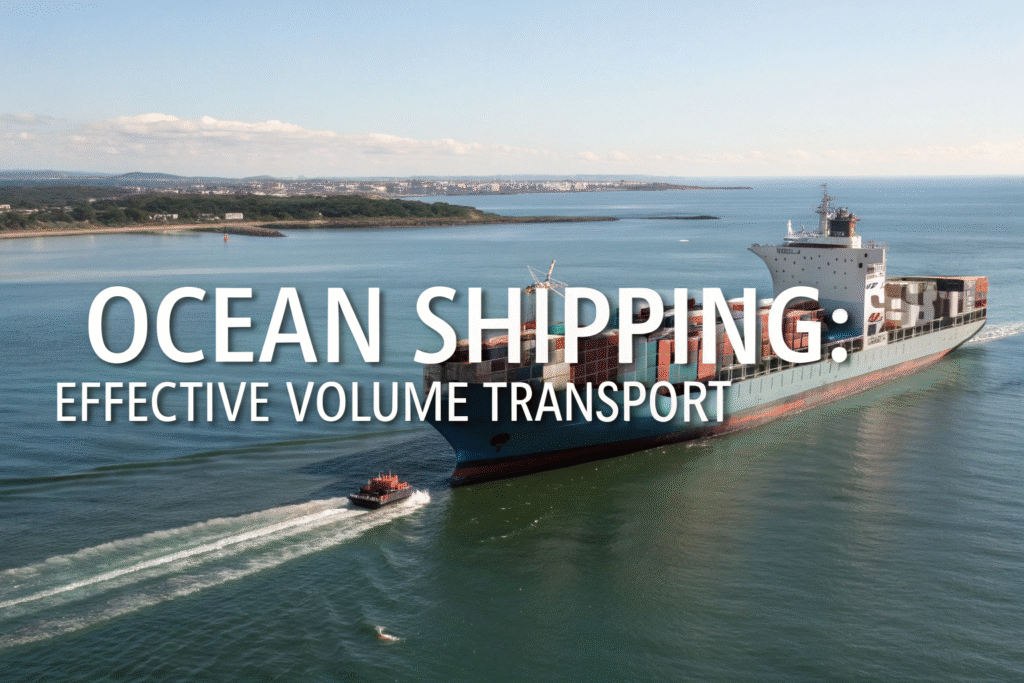

Why is sea freight preferred for volume shipments?

Ocean shipping remains the most cost-effective method for transporting large volumes of children's clothing to the United States, with per-unit costs substantially lower than air options despite longer transit times. For established brands with predictable inventory needs, sea freight provides unbeatable economies of scale.

Sea freight is preferred for volume shipments because of dramatically lower costs (typically 4-6 times cheaper than air), virtually unlimited capacity for large orders, environmental advantages through lower carbon emissions per item, and suitability for heavy/bulky items like winter coats. These advantages make it the default choice for seasonal inventory planning.

What container options work best for children's wear?

The choice between Full Container Load (FCL) and Less than Container Load (LCL) depends on volume, with FCL typically becoming economical at 15+ cubic meters. Children's clothing, being relatively lightweight, often cubes out before weighing out, making 40-foot containers particularly efficient. For smaller shipments, LCL allows sharing container space with other shippers, though this adds complexity and potential for delays during consolidation/deconsolidation. Our analysis shows that children's clothing brands shipping 5,000+ units per season typically benefit from FCL pricing and simplicity.

How can sea freight timing be optimized for seasonal business?

Strategic production planning must account for 30-45 day sea transit times plus 7-10 days for port processing. For back-to-school collections, production should complete by early May for July store arrivals. Holiday season goods need to ship by early August for October receipt. Building buffer time for potential delays is crucial—experienced shippers add 2-3 weeks contingency to published transit times. The most successful children's brands develop production calendars that align with shipping realities rather than optimistic best-case scenarios.

How does consolidated shipping reduce costs for smaller brands?

Consolidation services allow multiple shippers to share container space, creating economies of scale that make ocean shipping accessible to smaller children's clothing brands that cannot fill entire containers. This approach democratizes international shipping for emerging brands.

Consolidated shipping reduces costs for smaller brands by providing access to volume-based ocean rates, minimizing customs clearance fees through shared documentation processing, reducing port handling charges, and offering flexible volume commitments that grow with the business. These advantages help emerging brands compete with established players.

What are the operational advantages of consolidation services?

Consolidators handle the complex logistics of grouping multiple shipments, managing documentation for all parties, and coordinating customs clearance, allowing children's clothing brands to focus on their core business rather than logistics. Many consolidators specialize in fashion and understand the specific requirements for children's products, including CPSIA documentation and labeling compliance. This expertise is particularly valuable for brands new to US market entry who might otherwise struggle with complex regulatory requirements.

How do consolidation timelines compare to direct shipping?

While consolidated shipping typically adds 7-14 days to transit times compared to FCL, the cost savings of 30-50% over air freight make this delay acceptable for non-urgent inventory. The extended timeline comes from the additional handling at both origin and destination ports as containers are packed and unpacked with multiple shipments. For children's clothing brands with continuous replenishment needs rather than single seasonal shipments, the cost advantage of consolidation typically outweighs the slightly longer transit time.

What hybrid approaches balance speed and cost?

Sophisticated shippers often combine multiple transportation methods to optimize both inventory availability and shipping economics. These hybrid approaches acknowledge that different portions of a collection have different urgency and volume characteristics.

Hybrid approaches balance speed and cost by using air transport for initial samples and early inventory, sea freight for bulk replenishment, and regional distribution centers to enable quick final delivery within the US. This strategic combination ensures product availability while controlling overall logistics expenses.

How can transshipment through third countries reduce costs?

Some children's clothing brands serving both North American and European markets establish transshipment hubs in locations like Panama or Dubai where containers can be broken down and redirected. While adding complexity, this approach can reduce total transportation costs by optimizing container utilization across multiple markets. For example, a single container from China might carry both US-bound and Europe-bound goods, with separation occurring at a strategic intermediate location. The cost savings typically justify this approach only for companies shipping 20+ containers annually across multiple markets.

What role do US distribution centers play in hybrid strategies?

Maintaining inventory in US-based distribution centers allows children's clothing brands to use slower, cheaper ocean transport for bulk shipments while still offering customers quick delivery through domestic ground services. This approach requires forecasting demand and maintaining safety stock, but dramatically improves customer satisfaction through faster delivery. Many third-party logistics providers (3PLs) specialize in serving international children's brands, offering integrated services that include customs clearance, quality inspection, storage, and fulfillment.

What compliance considerations impact shipping choices?

Shipping children's clothing to the United States involves navigating complex regulatory requirements that significantly impact logistics decisions. Non-compliance can result in customs delays, rejected shipments, or even penalties, making understanding these requirements essential for smooth import operations.

Compliance considerations impacting shipping choices include CPSIA documentation requirements, country of origin labeling rules, customs bond requirements, import duty optimization strategies, and packaging/labeling standards that vary by US state. These regulatory factors often determine the most efficient shipping approach.

How do CPSIA requirements affect shipping preparation?

The Consumer Product Safety Improvement Act requires children's clothing manufacturers to maintain testing documentation and certificates of compliance for each product style. Shipping without proper documentation risks customs holds and potential rejection. Experienced shippers include CPSIA documentation with each shipment and work with customs brokers who understand how to properly file this information. Some shipping methods, particularly integrated air express services, include streamlined processes for submitting compliance documentation electronically in advance of arrival.

What tariff optimization strategies reduce import costs?

Children's clothing falls under various Harmonized Tariff Schedule codes with duty rates ranging from 0% to 32% depending on specific materials, construction, and intended use. Strategic classification can significantly impact landed costs. For example, certain sleepwear classifications carry higher duty rates than daywear. Working with experienced customs brokers who understand the nuances of children's clothing classification can yield substantial savings. Additionally, some materials or constructions may qualify for duty-free treatment under special trade programs, though these typically require substantial documentation.

Conclusion

Selecting the best shipping method for children's clothing destined for the US market requires careful analysis of order characteristics, timeline requirements, compliance capabilities, and total cost considerations. The most effective approach often involves a strategic combination of methods tailored to different aspects of the business—air for speed when needed, sea for cost-effective volume movement, and consolidation services for growing brands.

Beyond transportation mode selection, successful US market entry requires meticulous attention to compliance documentation, customs processes, and strategic inventory positioning that balances availability against carrying costs. Brands that master these logistics complexities gain significant competitive advantages through reliable delivery, cost control, and regulatory compliance.

Ready to optimize your children's clothing shipments to the USA? Our manufacturing and logistics expertise includes guiding brands through the complete process from production to compliant US delivery. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss how we can streamline your US shipping strategy.