The journey of a children's garment from our factory floor in Shanghai to a store shelf in Chicago or a warehouse in Cologne is a triumph of logistics. Yet, the most common point of failure isn't the sewing or the shipping—it's the paperwork. I've seen too many promising brand owners like Ron face devastating delays, steep fines, or even entire shipments being seized because of a misunderstood customs regulation. Navigating import and export customs is not an administrative afterthought; it's a critical strategic function that protects your cash flow, your timeline, and your brand's reputation. The process can seem like a labyrinth, but with the right knowledge and partners, it becomes a manageable, predictable part of your supply chain.

Successfully navigating customs regulations for kids' wear import/export requires a proactive, detail-oriented approach focused on three pillars: precise product classification using Harmonized System (HS) codes, rigorous preparation of compliance documentation (especially for safety standards), and strategic selection of logistics and Incoterms that clearly define responsibilities between buyer and seller.

This isn't about becoming a customs lawyer. It's about building a system that ensures your shipments are "clean" and predictable. The complexity is multiplied for children's wear due to stringent safety regulations, which customs agencies treat as non-negotiable gatekeepers. Let's map out the essential steps to clear customs smoothly, every time.

1. Why is Correct HS Code Classification the Most Critical First Step?

Imagine the HS code as your product's global passport number. It's a 6-10 digit number used by customs authorities in over 200 countries to identify exactly what you're shipping and determine the applicable duty rates, taxes, and regulatory requirements. Getting this code wrong is the single biggest cause of customs headaches.

For children's wear, classification goes beyond just "cotton shirt." The HS code will specify the garment type (e.g., t-shirt, trousers, dress), the fiber composition (e.g., 100% cotton, 65% polyester/35% cotton), and importantly, whether it's for babies or older children. Duty rates can vary dramatically based on these details. For example, in the US, the HS code for a baby girl's cotton knit shirt is different from that for a girl's cotton knit shirt, and the duty rates differ. You cannot rely on a guess or a code used for a similar item. The responsibility for correct classification ultimately falls on the importer of record (usually the buyer), but a reliable exporter (like our factory) will provide a suggested HS code based on the product's detailed specifications.

How Can You Verify and Manage HS Codes?

Do not accept a code from your supplier without verification. Use official resources:

- United States: The U.S. International Trade Commission (USITC) Harmonized Tariff Schedule (HTS) online database.

- European Union: The EU's TARIC (Integrated Tariff of the European Communities) database.

- General: Many countries have freely accessible online lookup tools.

For complex items or large shipments, investing in a customs broker's advice for classification is wise. Maintain a master product list in your internal system that links each SKU to its verified HS code, fabric composition, and country of origin. This becomes your source of truth for all documentation.

What is the Role of "Country of Origin" and Why Does It Matter?

"Country of Origin" isn't just where the shipment departed from; it's where the goods were "substantially transformed." For garments sewn in China from Chinese fabric, the origin is China. This designation affects:

- Duty Eligibility: It determines if your goods qualify for reduced or zero duty under Free Trade Agreements (FTAs) (e.g., USMCA, ASEAN). Most US-China trade does not benefit from such agreements, making accurate classification for standard rates even more important.

- Labeling Requirements: Many countries require permanent "Made in [Country]" labels on the garment itself. This is a separate requirement from shipping documents but is often checked at customs.

2. What Documentation is Non-Negotiable for a Smooth Customs Clearance?

Customs clearance is a documentary exercise. Your shipment's paperwork tells its story to the border agent. Missing or incorrect documents are an automatic red flag. For kids' wear, the documentation packet has two layers: standard commercial documents and critical compliance certificates.

The commercial core includes:

- Commercial Invoice: Must precisely match the goods, with value, HS codes, and a detailed description.

- Packing List: Itemizes contents of each carton, with weights and dimensions.

- Bill of Lading (B/L) or Air Waybill (AWB): The contract of carriage between shipper and carrier.

- Certificate of Origin: Often required to formally declare the origin country.

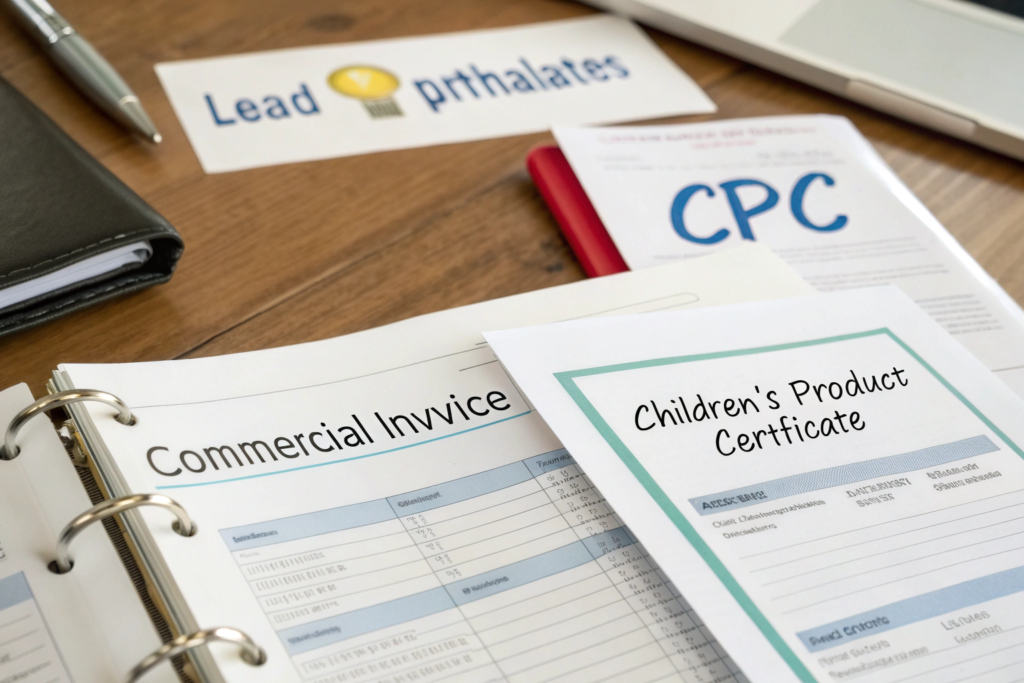

The compliance core for children's wear is where specialization is vital. This is your proof that the products are safe and legal for sale. Key documents include:

- Children's Product Certificate (CPC) for USA: For goods subject to CPSIA (Consumer Product Safety Improvement Act), this document is mandatory. It affirms the product was tested by a CPSC-accepted lab and complies with all applicable safety rules.

- Test Reports: The actual lab reports (e.g., from Intertek, SGS, Bureau Veritas) for lead, phthalates, flammability (for sleepwear), and other standards. Customs may request these to back up the CPC.

- EU Declaration of Conformity & CE Marking Documentation: For the European market, you must have technical documentation proving compliance with the General Product Safety Regulation (GPSR) and relevant standards like EN 14682 for drawstrings.

Why is Accurate Valuation on the Commercial Invoice Essential?

Undervaluing goods to save on duties is illegal (customs fraud) and carries severe penalties. The invoice must declare the correct transaction value (what you paid the supplier). Customs authorities have extensive databases and can flag values that seem too low for the described goods, leading to audits, delays, and fines. Honesty is the only policy here.

How Should You Handle Documentation for DDP Shipments?

If you work with a supplier like us who offers DDP (Delivered Duty Paid) terms, the documentation burden shifts significantly. As the exporter and shipper, we become responsible for preparing most of the export declaration from China, coordinating with a freight forwarder and customs broker in the destination country, paying the duties and taxes, and ensuring all compliance documents are in order for clearance. For you, the importer, this simplifies the process immensely, but you should still request copies of key documents (like the CPC and test reports) for your own records and retail due diligence.

3. How Do Incoterms and Your Logistics Partner Define Clearance Responsibility?

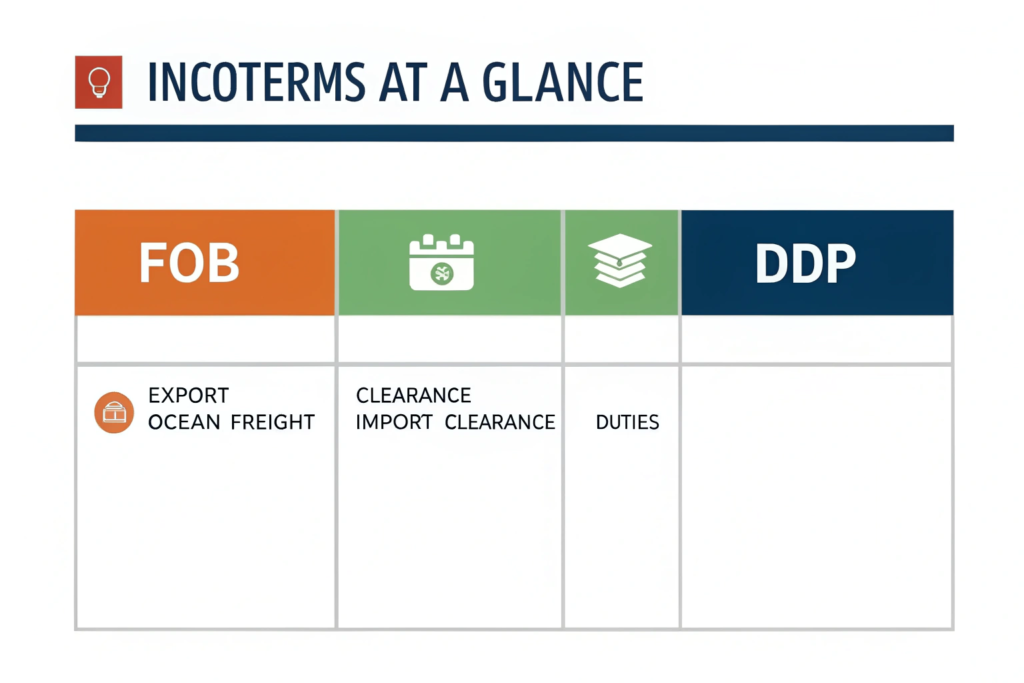

Confusion over who does what is a major source of customs problems. Incoterms® 2020 are internationally recognized trade terms that precisely allocate costs and risks between buyer and seller, including the critical task of customs clearance.

Choosing the right Incoterm is a strategic decision. The two most common for China-US/EU trade are:

- FOB (Free On Board) Shanghai: The seller (us) is responsible for getting the goods loaded onto the ship/plane and clearing them for export from China. The buyer (you) is responsible for all costs and risks from that point forward: main carriage, insurance, and import customs clearance, duties, and taxes in the destination country. Under FOB, the buyer typically hires and instructs the customs broker.

- DDP (Delivered Duty Paid) Your Warehouse: The seller (us) is responsible for all costs and risks until the goods are delivered to your designated address, cleared for import, with all duties and taxes paid. Under DDP, the seller manages the entire process, including destination customs clearance.

Your choice dictates your team's workload and risk. For brands new to importing or without dedicated logistics staff, DDP provides tremendous peace of mind and predictability.

How to Select and Work with a Customs Broker or Freight Forwarder?

Unless you are on DDP terms, you will need a partner in the destination country. A licensed customs broker is authorized to submit entries to customs on your behalf. Many freight forwarders have an in-house brokerage or a partnered firm.

- Choose a specialist: Work with a broker experienced in textile/apparel imports and, ideally, children's products. They will understand the specific documentation and testing requirements.

- Provide complete information upfront: Give them your complete documentation packet (invoice, packing list, compliance certs) as early as possible. The more they know, the faster they can clear your goods.

- Understand their fees: Brokerage fees are separate from duties/taxes and transportation costs. Get a clear quote.

What Are the Common "Red Flags" That Trigger Customs Inspections?

While some inspections are random, many are triggered. Avoid these red flags:

- Incomplete or inconsistent paperwork.

- Incorrect or missing HS codes.

- Suspected undervaluation.

- Shipments from a supplier or industry with a known history of violations (e.g., unauthorized transshipment to evade duties).

- For kids' wear: lack of visible compliance certificates or safety labels on the products themselves.

An inspection can add days or weeks to your timeline and incur extra costs (examination fees, demurrage). Preparation is your best defense.

4. How to Stay Proactive and Build a Compliant Supply Chain?

Customs compliance isn't a one-time event; it's an ongoing part of your supply chain management. A reactive approach guarantees future problems. A proactive approach builds resilience.

Start compliance at the design and sourcing stage. When you develop a new product with your manufacturer, the conversation must include: "What safety standards does this need to meet for our target market? What testing will be required? What labeling (care, content, origin) is mandatory?" This ensures the product is built to be compliant, not just tested afterwards. Work with your factory to establish a documentation protocol. At Fumao, we provide a standardized dossier for each order that includes the commercial documents, the relevant test reports/certificates, and a packing list that mirrors the shipment exactly. This systemization prevents last-minute scrambles.

How to Manage Updates to Regulations?

Regulations change. New substances get restricted, labeling rules update, and trade policies shift. You cannot assume what was compliant last year is compliant this year.

- Subscribe to updates: Follow official sources like the CPSC (USA), European Commission (EU), and your national customs authority.

- Leverage your partners: A good manufacturer and customs broker will proactively inform you of major regulatory changes affecting your product category. Make this a topic of regular business reviews.

- Re-test as necessary: If a standard is updated or you change a material supplier, new testing may be required. Factor this into your development timeline and cost.

What is the Role of Technology in Simplifying Compliance?

Leverage digital tools where possible. Many logistics platforms now offer digital document management, reducing the risk of lost papers. Some advanced systems can help with HS code lookup and duty calculation. While not a replacement for expert advice, they can streamline the process and maintain organized records for audits. The key is to have a single, accessible digital repository for all compliance and shipping documents related to each order.

Conclusion

Navigating customs for kids' wear import/export is a disciplined practice of preparation, precision, and partnership. It hinges on classifying your products correctly, assembling a bulletproof package of commercial and compliance documents, clearly defining responsibilities through Incoterms, and choosing experienced logistics partners. For children's apparel, where safety is paramount, customs clearance is more than a tax formality—it's a mandatory checkpoint that validates your product's right to enter the market.

By embedding customs awareness into your product development cycle and viewing your manufacturer and broker as strategic allies in compliance, you transform a potential bottleneck into a smooth, predictable pathway. This diligence protects your investment, ensures timely market entry, and safeguards the trust you're building with your customers.

Don't let customs be the cliffhanger in your supply chain story. Partner with a manufacturer who understands the full journey. Contact our Business Director, Elaine, at elaine@fumaoclothing.com to discuss how Shanghai Fumao's expertise in compliant production and logistics can ensure your next shipment arrives smoothly, on time, and ready for success.