Cash flow management is the lifeblood of your children's clothing business. Many promising brands, even with strong sales, falter because they run out of cash at critical moments. As a manufacturer who has partnered with countless startups and established brands, I've seen firsthand how strategic cash flow planning separates thriving businesses from struggling ones. It’s not just about profit on paper; it's about having the money in the bank when you need to pay for fabric, production runs, and marketing.

Effective cash flow management for a kids clothing business involves meticulous forecasting, strategic timing of inventory purchases, proactive customer payment collection, and building strong financial partnerships with suppliers. The goal is to shorten the cash conversion cycle so money flows in faster than it flows out.

You may have a fantastic collection, but if you can't fund the next production run because payments are tied up, growth stalls. Let's dive into practical, actionable strategies tailored to the unique rhythms and demands of the children's apparel industry to keep your finances healthy and your business agile.

What Are the Biggest Cash Flow Challenges for Children's Apparel Brands?

The children's wear sector presents specific cash flow hurdles that generic business advice often misses. Seasonality, long lead times, and the high cost of inventory create a perfect storm for cash crunches. Understanding these challenges is the first step to overcoming them.

The biggest cash flow challenges include the long cash conversion cycle from paying for production to receiving retail sales revenue, the burden of funding large inventory purchases for seasonal peaks, the high upfront costs of compliance and fabric testing, and the risk of unsold stock from changing trends.

How Does Seasonality Impact Your Cash Flow Cycle?

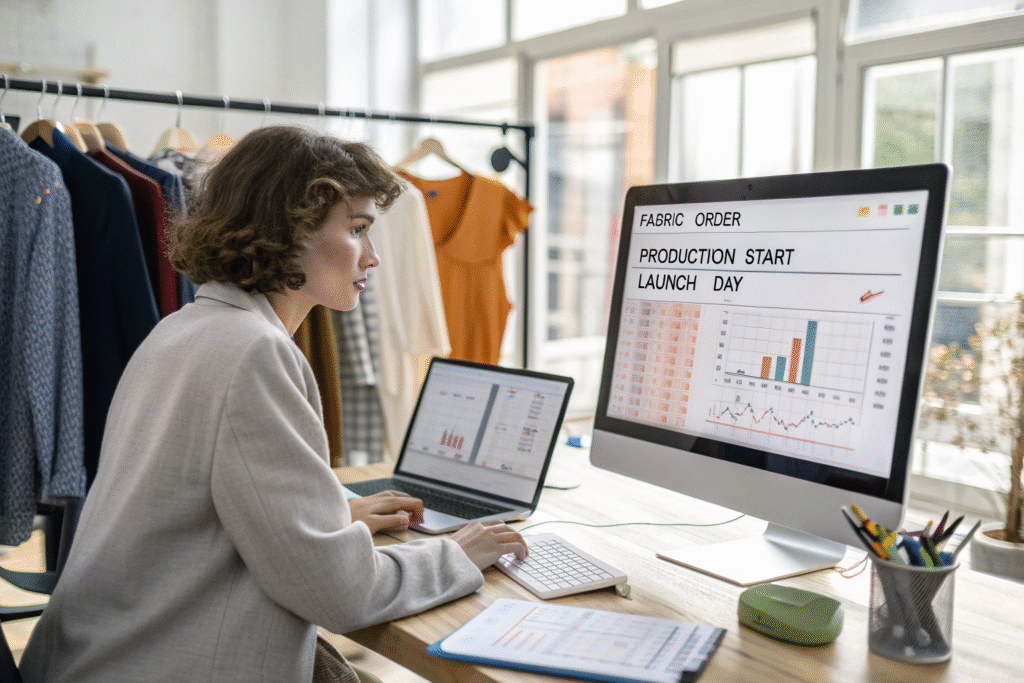

Seasonality creates a feast-or-famine cash flow pattern. You must pay your manufacturer in full, often before production even begins or upon shipment, to secure your inventory for peak seasons like Back-to-School or Holidays. This massive cash outflow happens months before you see a single dollar from customers. Then, after the season, you may be left with cash tied up in slow-moving stock, while you need funds to start developing the next season's line. This cycle requires disciplined forecasting and often, a line of credit to bridge the gaps. Planning for seasonal demand is critical, and tools for inventory management can help optimize stock levels.

Why are Upfront Production Costs a Major Hurdle?

Unlike some industries, apparel manufacturing requires significant upfront investment. You pay for fabric, trims, labor, and shipping long before the finished goods land in your warehouse. For a new or growing kids clothing business, this can drain cash reserves quickly. A typical order might require a 30% deposit upon order confirmation, 70% before shipment, and then you incur shipping and duty costs. The entire amount is spent before you can even list the product for sale. This makes building a strong relationship with a flexible manufacturer and understanding all production costs crucial for accurate cash flow projections.

How Can You Forecast Cash Flow Accurately for an Apparel Business?

Accurate forecasting is your financial roadmap. It helps you anticipate shortfalls and make informed decisions about production quantities, marketing spends, and hiring. A forecast is not a guess; it's a data-driven model based on your business's specific rhythms.

Accurate cash flow forecasting combines historical sales data, detailed knowledge of production costs and timelines, realistic sales projections for new lines, and a clear understanding of your payment terms with both suppliers and customers. It should be a rolling 12-month model updated monthly.

What Key Data Points Should Your Cash Flow Model Include?

Your forecast must be as detailed as your tech pack. Essential data points include:

- Cash Inflows: Projected sales (broken down by product line/channel), timing of customer payments (e.g., Net 30 days after invoice), and any other income.

- Cash Outflows: Manufacturing deposits and final payments, fabric and trim costs, freight and logistics fees, import duties, payroll, marketing expenses, rent, and software subscriptions.

- Timing: The exact timing of each outflow and inflow is more important than the amount. Align payment due dates for production with your expected revenue cycles.

How to Use Historical Sales Data for Smarter Inventory Planning?

Past performance is your best indicator of future cash needs. Analyze which styles, sizes, and colors sold best and at what velocity. This data should directly inform your Minimum Order Quantity (MOQ) decisions with your manufacturer. Instead of guessing, use historical sell-through rates to forecast demand for similar new items. This prevents over-ordering, which locks up cash in dead stock, and under-ordering, which misses sales. Investing in a good inventory management system that provides this analytics is a cash flow safeguard.

What Strategies Improve Incoming Cash Flow from Sales?

Accelerating the speed at which money enters your business is a powerful lever. This means reducing the gap between making a sale and having the cash available to use. For wholesale brands, this is particularly challenging but manageable with the right tactics.

Strategies to improve incoming cash flow include offering early payment discounts to wholesale buyers, requiring deposits for large or custom orders, incentivizing direct-to-consumer (DTC) sales which typically have faster payment cycles, and using efficient online payment gateways.

How Can Payment Terms with Retailers Be Optimized?

If you sell wholesale, your standard Net 60 terms can create a huge cash flow gap. You've paid your manufacturer and shipped goods to the store, but you won't see payment for two months. To improve this:

- Offer a small discount (e.g., 2%) for payments made Net 10. Many retailers will take this to improve their own margins.

- For new or small retailers, start with Net 30 or require a deposit.

- Use a factoring service as a tool, selling your invoices for immediate cash (at a cost) to cover urgent expenses during growth spurts.

Clear payment terms should be part of your wholesale agreement from the start.

Why is a Direct-to-Consumer (DTC) Channel Beneficial for Cash Flow?

A DTC e-commerce channel, even if small, can be a cash flow lifeline. Sales on your website are typically paid via credit card at the moment of purchase. This means immediate cash inflow, drastically shortening your cash conversion cycle. The profit margin is also often higher. You can use this faster-turning revenue from DTC sales to help fund the longer-cycle wholesale side of your business. Promoting pre-orders for new collections through your DTC channel is an excellent way to generate cash before you have to pay your manufacturer's final invoice.

How to Manage Outgoing Cash Flow with Suppliers and Operations?

Controlling the timing and amount of money leaving your business is just as critical as accelerating inflows. Smart management of payables and operational costs preserves cash for where it's needed most.

Manage outgoing cash flow by negotiating favorable payment terms with suppliers, carefully timing inventory purchases to match sales cycles, controlling operational overhead, and planning for tax obligations proactively.

How to Negotiate Better Payment Terms with Your Clothing Manufacturer?

Your manufacturer is a key financial partner. While large deposits are standard, there is room for negotiation as trust builds.

- Build a Relationship: Demonstrate reliability with on-time payments and clear communication.

- Propose Staged Payments: Instead of 30/70, suggest a structure tied to production milestones: 30% at order, 40% at cutting, 30% before shipment. This aligns your cash outflows with the production progress.

- Leverage Larger Orders: Use planned, larger volume orders to negotiate slightly extended final payment terms (e.g., paying the balance 15 days after shipment instead of before).

A manufacturer invested in your growth, like Fumao, will work with reliable partners to find a sustainable financial arrangement.

What Operational Costs Are Often Overlooked in Cash Flow Planning?

Beyond the obvious costs of goods sold, several recurring expenses can sneak up and disrupt cash flow:

- Storage and Warehousing: Costs rise with unsold inventory.

- Shipping and Returns: Customer returns, especially in e-commerce, reverse your cash inflow.

- Credit Card Processing Fees: A significant percentage of every online sale.

- Duties and Tariffs: Fluctuating rates can create unexpected costs at customs.

- Photography and Marketing for Each Season: A necessary but sizable cash outflow before any new line launches.

Budgeting for these in your cash flow forecast is essential for accuracy.

Conclusion

Mastering cash flow in the kids clothing business is an ongoing discipline of forecasting, strategic timing, and relationship management. It requires you to be both a visionary designer and a pragmatic finance manager. By understanding your unique cycle, accelerating inflows from sales, thoughtfully managing outflows to suppliers, and maintaining a rigorous forecast, you build a financially resilient brand capable of weathering seasons and seizing growth opportunities.

Remember, a supportive manufacturing partner understands these pressures. At Fumao Clothing, we’ve structured our processes to be transparent and predictable, helping you plan your finances with confidence. If you're looking for a manufacturer who values partnership and financial clarity as much as you do, let's discuss how we can align our schedules and terms to support your cash flow health. For a consultation on producing your next collection with financial foresight, contact our Business Director, Elaine, at elaine@fumaoclothing.com.