Navigating customs clearance for children's clothing imports requires meticulous preparation and understanding of complex international regulations. As a manufacturer who has facilitated shipments to over 30 countries, I've developed systems that streamline this process while ensuring full compliance with destination market requirements.

Successful customs clearance for kids clothing imports requires proper HS code classification, accurate documentation, compliance with safety standards, and strategic partnership with experienced customs brokers. The process demands attention to detailed regulations specific to children's products, including safety certifications, labeling requirements, and country-specific import restrictions.

Customs clearance represents one of the most challenging aspects of international children's wear trade, but systematic preparation can transform it from a barrier into a competitive advantage. Let's explore the key components of efficient customs clearance.

What documentation is essential for smooth clearance?

Proper documentation forms the foundation of successful customs clearance. Incomplete or inaccurate paperwork represents the most common reason for shipment delays, inspections, and additional fees. Having all documents prepared correctly before shipment saves significant time and money.

Essential documents include commercial invoices, packing lists, certificates of origin, bill of lading or air waybill, and import licenses or permits where required. Each document must contain specific information that customs authorities verify against the actual shipment.

Why are detailed commercial invoices critical?

Detailed commercial invoices are critical because they provide the foundation for customs valuation, duty assessment, and regulatory compliance verification. Beyond basic sender and receiver information, commercial invoices for children's clothing must include detailed product descriptions, harmonized system (HS) codes, fabric composition percentages, country of origin, and accurate declared values. According to U.S. Customs and Border Protection guidelines, incomplete commercial invoices account for approximately 30% of customs delays. For children's wear specifically, invoices should specify whether items are for babies, toddlers, or older children, as duty rates and safety requirements often differ by age category. The most thorough invoices also include manufacturing facility information and reference safety compliance certificates to preemptively address potential regulatory questions.

How does certificate of origin impact duty rates?

Certificate of origin significantly impacts duty rates because it determines whether shipments qualify for preferential treatment under free trade agreements or special programs. Different countries have varying rules of origin requirements, but generally, substantial transformation (changing the article to a new and different article of commerce) must occur in the exporting country. The table below shows how origin affects duty rates for children's clothing in major markets:

| Country | Standard Duty Rate | Preferential Rates Available |

|---|---|---|

| United States | 10-20% depending on item | NAFTA/USMCA, GSP, CBTPA |

| European Union | 12% average | GSP, bilateral agreements |

| United Kingdom | 12% average | UK Trade Agreements |

| Australia | 5-10% depending on item | ASEAN-Australia-New Zealand FTA |

Properly executed certificates of origin can reduce or eliminate duties entirely, creating significant cost savings. However, incorrect claims can result in penalties, back-duty payments, and loss of preferential status. Working with experienced trade professionals ensures accurate origin claims that maximize savings while maintaining compliance.

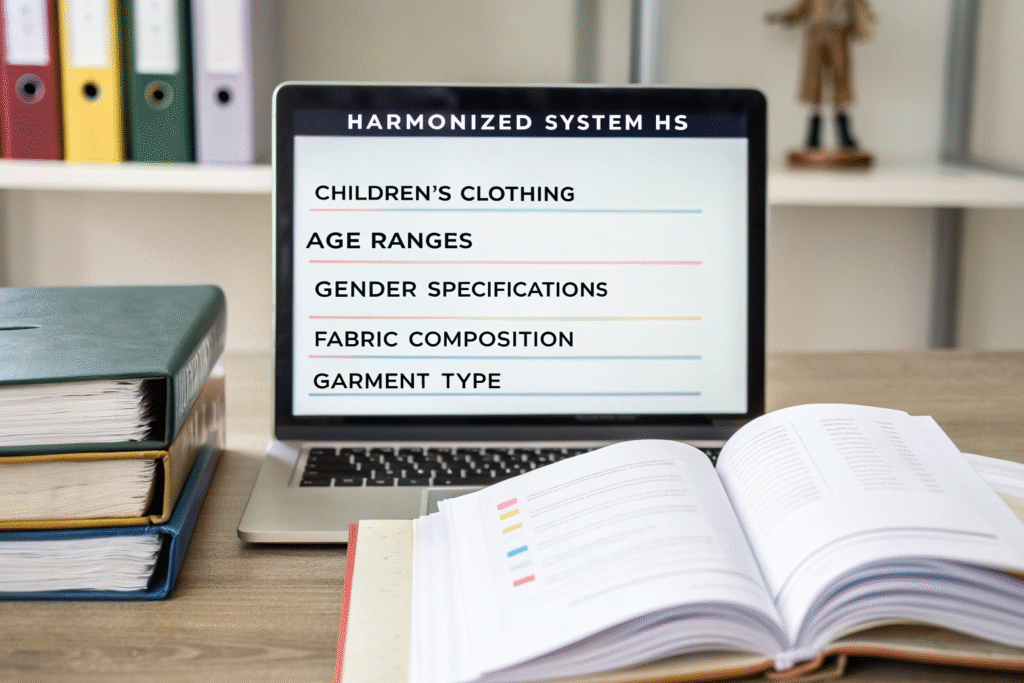

How to correctly classify children's clothing?

Correct classification under the Harmonized System (HS) is essential for determining duty rates, eligibility for trade programs, and compliance with product-specific regulations. Children's clothing presents particular classification challenges due to varying definitions of child age categories across different markets.

Key classification considerations include age ranges, gender specifications, fabric composition, and garment type. Each factor influences the appropriate HS code and consequent regulatory requirements.

What are the most common HS codes for kids wear?

The most common HS codes for kids wear fall under Chapter 61 (knitted apparel) and Chapter 62 (woven apparel) with specific subheadings for different garment types and age ranges. Accurate classification requires understanding subtle distinctions that significantly impact duty rates. For example:

- 6111.20.60: Babies' knitted cotton sweaters, pullovers & similar (US duty 5.9%)

- 6109.10.00: Cotton t-shirts, knitted, for infants (US duty 16.5%)

- 6209.20.10: Cotton babies' woven garments (US duty 8.1%)

- 6110.20.20: Cotton knitted sweaters for children (US duty 16%)

According to World Customs Organization guidelines, misclassification represents one of the most common customs errors, potentially triggering audits, delays, and penalties. The distinction between "babies'" clothing (generally under 24 months) and "children's" clothing varies by market, requiring careful attention to each country's specific definitions. Working with classification experts or using automated classification tools can prevent costly errors in this complex area.

How does age categorization affect classification?

Age categorization significantly affects classification because different duty rates and safety regulations apply to various age groups across international markets. Most countries distinguish between clothing for babies (typically under 24 months), young children (2-7 years), and older children (8+ years), with some markets having additional categories. The European Union's age categorization specifically affects duty rates, with babies' clothing often receiving preferential treatment. Additionally, safety regulations like small parts requirements for children under 3 years in the US and flammability standards for children's sleepwear up to size 14 must be reflected in documentation. Proper age categorization ensures correct duty assessment while demonstrating compliance with safety standards specific to each age group.

What safety compliance documents are required?

Children's clothing imports face stringent safety requirements that vary by destination market. Proper documentation demonstrating compliance prevents costly rejections, recalls, or destruction of non-compliant shipments.

Key compliance documents include children's product certificates, laboratory test reports, flammability certifications, and chemical compliance documentation. Each market has specific requirements that must be addressed before shipment.

Why are children's product certificates mandatory?

Children's product certificates are mandatory because they provide official documentation that products meet all applicable safety standards of the destination market. In the United States, the Consumer Product Safety Improvement Act (CPSIA) requires Children's Product Certificates (CPCs) for items intended for children 12 and under. Similarly, the European Union requires Declaration of Conformity documents demonstrating compliance with the General Product Safety Directive and specific standards like EN 14682 for drawstrings in children's clothing. These certificates must be based on third-party testing from accredited laboratories and include detailed product description, applicable safety rules, contact information for importer and manufacturer, and test results. Without proper certification, customs authorities may detain shipments indefinitely, requiring expensive retesting or resulting in complete rejection.

How do flammability standards impact import requirements?

Flammability standards significantly impact import requirements because children's sleepwear faces particularly stringent regulations in most Western markets. In the United States, the Children's Sleepwear Regulations under 16 CFR Parts 1615 and 1616 require specific testing and certification for sleepwear items sized 0-14. The European Union's EN 14878 specifies flammability requirements for children's nightwear, while Australia/New Zealand has AS/NZS 1249. These standards typically require either inherently flame-resistant fabrics or treated materials that maintain flame resistance through multiple washings. Import documentation must reference compliance with these standards, and shipments may be subject to verification testing by customs authorities. Failure to comply can result in seizure, mandatory destruction, and significant fines, making proper flammability documentation essential for any children's sleepwear imports.

How to work effectively with customs brokers?

Experienced customs brokers provide invaluable expertise in navigating complex import regulations, but the relationship requires active management and information sharing to be effective. Choosing the right broker and establishing clear communication protocols significantly impacts clearance efficiency.

Key aspects of broker management include careful selection, comprehensive information sharing, established communication protocols, and regular performance review. Each element contributes to a partnership that prevents problems rather than simply reacting to them.

What information should you provide your broker?

You should provide your broker with comprehensive information including detailed product descriptions, manufacturing processes, full material breakdowns, supplier documentation, and complete commercial terms. Specifically for children's clothing, brokers need:

- Complete technical specifications: Fiber content percentages, construction methods, finishes applied

- Safety compliance documentation: Test reports, certificates, applicable standards met

- Manufacturing details: Factory information, production processes, quality control measures

- Shipping information: Incoterms, transportation details, packaging specifications

- Commercial details: Payment terms, relationship with suppliers, valuation methodology

According to National Customs Brokers & Forwarders Association guidelines, incomplete information represents the primary cause of customs delays and compliance issues. Providing brokers with comprehensive information before shipment allows them to identify potential problems, suggest corrective actions, and prepare accurate documentation in advance. This proactive approach transforms customs clearance from a reactive process to a strategic advantage.

How can broker selection impact clearance efficiency?

Broker selection significantly impacts clearance efficiency because experienced brokers with specific children's product expertise navigate complex regulations more effectively, identify potential issues proactively, and maintain stronger relationships with customs authorities. Key selection criteria should include:

- Industry specialization: Experience with textile and children's product imports

- Port-specific expertise: Knowledge of particular port procedures and personnel

- Technology capabilities: Advanced tracking and documentation systems

- Communication protocols: Clear reporting structures and response time commitments

- Problem-resolution history: Demonstrated ability to resolve compliance issues efficiently

Data from International Trade Administration indicates that importers using specialized brokers experience 40% fewer customs delays and 25% lower compliance costs. The most effective relationships involve brokers as strategic partners rather than transactional service providers, with regular communication about regulatory changes, trade program opportunities, and process improvements that benefit both parties.

What are common pitfalls and how to avoid them?

Understanding common customs clearance pitfalls allows importers to develop preventive strategies that minimize delays, additional costs, and compliance issues. Many problems stem from preventable errors in documentation, classification, or compliance verification.

Common pitfalls include incorrect valuation, improper classification, inadequate documentation, and non-compliance with safety standards. Each area requires specific strategies to avoid problems.

Why do valuation disputes frequently occur?

Valuation disputes frequently occur because customs authorities carefully scrutinize declared values to prevent duty evasion and ensure accurate revenue collection. The World Trade Organization's Customs Valuation Agreement establishes transaction value as the primary basis for customs valuation, but complications arise with related-party transactions, royalty payments, assists, and other non-standard arrangements. Common valuation issues include:

- Related-party transactions: Sales between affiliated companies require additional documentation

- Assists: Tools, dies, molds, or design work provided free of charge must be included in value

- Royalties and license fees: Payments for intellectual property may be dutiable

- Post-importation commissions: Some selling commissions must be included in value

Maintaining detailed records of all cost components, preparing transfer pricing documentation for related-party transactions, and working with valuation experts can prevent disputes that lead to delays, audits, and potential penalties.

How can compliance verification prevent delays?

Compliance verification before shipment prevents delays by identifying and resolving potential issues before customs authorities encounter them. A thorough pre-shipment review should verify:

- Documentation completeness: All required certificates, licenses, and declarations

- Classification accuracy: HS codes verified against binding rulings or expert opinion

- Marking and labeling: Country of origin labels, fiber content, care instructions

- Safety standards: Compliance with all applicable children's product regulations

- Recordkeeping systems: Documentation organized for potential audit

According to U.S. Customs and Border Protection data, shipments with complete compliance documentation clear customs 65% faster than those requiring additional verification. Implementing a checklist system that verifies all requirements before shipment significantly reduces the risk of examinations, detentions, or rejections that disrupt supply chains and increase costs.

Conclusion

Successful customs clearance for children's clothing imports requires meticulous attention to documentation, accurate classification, comprehensive safety compliance, and strategic partnership with experienced customs professionals. By understanding the specific requirements for children's products and implementing systematic processes, importers can transform customs clearance from a regulatory hurdle into a competitive advantage.

The most successful importers treat customs compliance as an integral part of their supply chain strategy rather than an administrative afterthought. If you're importing children's clothing and need manufacturing partnership from a company with extensive international shipping experience, contact our Business Director Elaine at elaine@fumaoclothing.com. Let Shanghai Fumao's expertise in global children's wear trade help you navigate customs processes efficiently while maintaining full compliance.