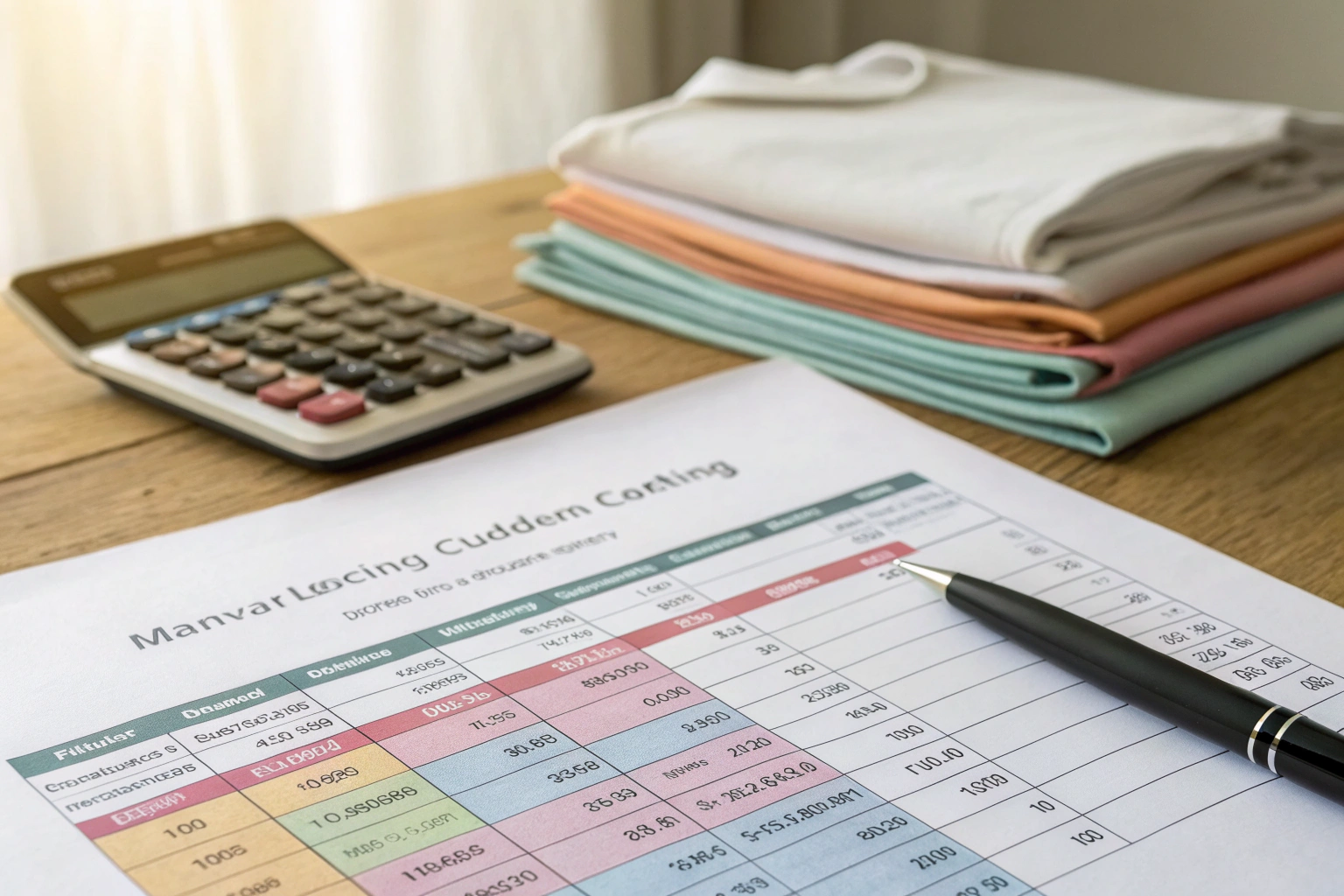

Last quarter, one of our startup brand partners faced a harsh reality: their beautifully designed children's rompers were actually costing them $2.15 more to produce than they had calculated. After accounting for all the hidden expenses they'd overlooked, their profitable product suddenly became a loss leader. This scenario is far too common in our industry, which is why understanding true manufacturing costs isn't just accounting - it's survival.

The true cost of manufacturing kids clothing includes direct material costs, labor expenses, factory overhead, compliance testing, shipping and logistics, quality control, and profit margins. Most brands underestimate by 25-40% by focusing only on fabric and labor while missing critical components like trims, testing, and operational overhead.

Calculating true costs requires looking beyond the obvious and understanding the entire production ecosystem. From the moment fabric is sourced to when finished garments reach your warehouse, numerous cost components accumulate. Brands that master this calculation don't just avoid losses - they make smarter decisions about design, pricing, and production strategy.

What Are The Direct Material Costs Beyond Basic Fabric?

Direct materials form the foundation of your cost calculation, but most brands only account for main fabric while missing numerous other essential components. Understanding the complete material picture prevents unexpected cost overruns during production.

The main fabric typically represents 45-60% of direct material costs, but this varies significantly by garment type. A simple cotton t-shirt might have 85% of material costs in the main fabric, while a detailed jacket with multiple components might only allocate 40% to the shell fabric. This complexity increases with children's wear, where smaller pieces and specialized materials can create disproportionate cost impacts.

What material components are most frequently overlooked?

Brands consistently underestimate these material elements:

- Interlinings and reinforcements: Collar stays, cuff reinforcements, placket backings

- Thread consumption: Different stitch types (overlock, coverstitch, single needle) use varying thread amounts

- Labels and packaging: Main labels, care labels, size tags, polybags, hangtags

- Trims and accessories: Buttons, zippers, snaps, elastics, drawcords, toggles

- Consumables: Perforated copy paper for cutting, miscellaneous sewing supplies

We recently analyzed a client's order and discovered that their "minor" trims and labels actually represented 18% of their total material cost - a significant amount they had completely overlooked in their initial calculations.

How can you accurately calculate fabric consumption?

Use technical packs with precise pattern pieces to calculate exact fabric requirements. Consider these factors:

- Fabric width: Standard widths vary (44/45", 58/60", etc.) affecting yardage needs

- Pattern efficiency: How tightly pieces nest during cutting (typically 75-85% efficiency)

- Fabric defects: Industry standard allows 2-3% for flaws and cutting errors

- Shrinkage allowance: Additional 3-5% for fabric shrinkage during washing

We provide our partners with detailed fabric consumption reports that account for all these variables, ensuring accurate material costing from the beginning.

How Do Labor Costs Vary Across Different Production Stages?

Labor costs extend far beyond simple sewing operations and vary dramatically based on garment complexity, factory location, and skill requirements. Understanding these variations helps brands make informed decisions about design complexity and production location.

The labor cost structure typically breaks down into pre-production (pattern making, sampling), production (cutting, sewing, finishing), and quality control (inspection, pressing, packing). Each stage requires different skill levels with corresponding wage rates. For children's wear, the higher number of smaller pieces and detailed work often increases labor costs proportionally more than adult clothing.

What labor components should be included in calculations?

Comprehensive labor costing includes:

- Pre-production labor: Pattern making, grading, marker making

- Cutting room labor: Spreading, cutting, bundling, numbering

- Sewing operations: Basic sewing, detailed work, special attachments

- Finishing processes: Trimming, pressing, folding, packaging

- Quality control: In-process checking, final inspection

One of our clients discovered that their intricate appliqué designs were adding 35 minutes of specialized labor per garment - a cost they hadn't accounted for in their initial pricing. According to the International Labour Organization, skilled sewing operators in China typically earn 25-40% more than basic machine operators, highlighting the importance of accounting for skill differentials.

How does garment complexity impact labor costs?

Use the Standard Minute Value (SMV) system to quantify labor requirements:

- Basic garments: T-shirts (8-12 SMV), simple pants (15-20 SMV)

- Moderate complexity: Dresses with details (25-35 SMV), jackets (40-60 SMV)

- High complexity: Technical outerwear (70-100+ SMV), elaborate formalwear

We provide SMV calculations for all our clients' designs, allowing accurate labor costing regardless of complexity. This system accounts for the reality that a child's garment with multiple small pieces and detailed finishing often requires more skilled labor minutes than a simpler adult garment.

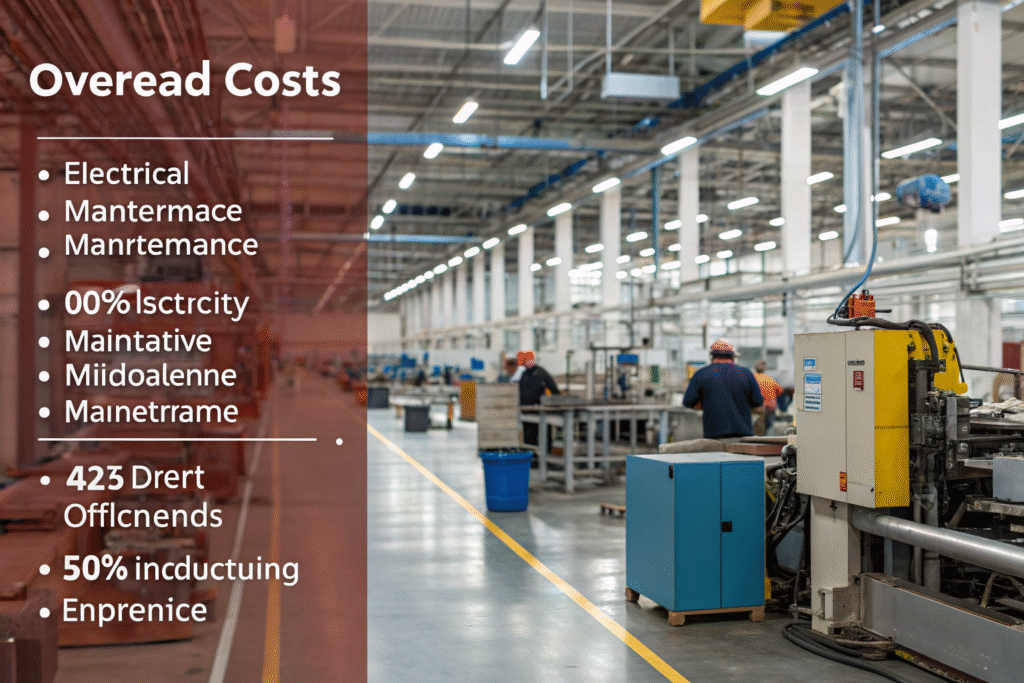

What Factory Overhead and Operational Costs Are Often Missed?

Overhead costs represent the hidden infrastructure that enables production but often gets overlooked in initial calculations. These indirect costs can add 25-40% to your direct manufacturing expenses and vary significantly between factories.

Factory overhead includes everything from electricity and rent to administrative staff and equipment maintenance. While some factories charge overhead as a percentage of direct costs, others use more complex calculations based on machine hours, space utilization, or order complexity. Understanding your factory's overhead structure is crucial for accurate costing.

What overhead components should be included?

Comprehensive overhead accounting includes:

- Factory operations: Rent, utilities, equipment depreciation, maintenance

- Administrative costs: Management, accounting, purchasing, quality staff

- Compliance costs: Certifications, audits, safety equipment, training

- Development expenses: Sample making, pattern development, testing

We recently helped a client analyze why their costs were 30% higher than a competitor's and discovered the competitor wasn't accounting for equipment depreciation or compliance certifications - essentially comparing a fully costed product with one that missed critical overhead components.

How do minimum order quantities affect cost calculations?

MOQs significantly impact per-unit costs through several mechanisms:

- Setup costs: Pattern making, machine setup, and sample approval amortized across order quantity

- Material purchasing: Higher volumes often secure better fabric pricing

- Production efficiency: Larger runs achieve better worker proficiency and line balance

- Shipping economics: Container optimization versus less-than-container loads

The Fashion Institute of Technology recommends brands calculate costs at both their minimum viable quantity and optimal production quantity to understand the true cost of small-batch production. Our analysis shows that increasing order quantity from 500 to 2,000 pieces typically reduces per-unit costs by 18-25% through better overhead absorption and production efficiency.

What Compliance and Testing Costs Are Essential for Kids Wear?

Children's clothing carries significant additional compliance costs that adult apparel doesn't face. These mandatory expenses ensure safety and legal compliance but often surprise new brands with their impact on total costs.

The regulatory landscape for children's wear includes flammability standards, chemical restrictions, mechanical safety requirements, and labeling regulations. Each market has its own requirements, with the US (CPSIA), EU (REACH), and Australia having particularly stringent standards. These aren't optional - they're mandatory for legal sales.

What testing and certification costs are required?

Essential compliance costs include:

- Fabric testing: Physical properties, colorfastness, fiber content verification

- Chemical testing: Heavy metals, phthalates, formaldehyde, AZO dyes

- Safety testing: Small parts, drawstrings, sharp points/edges

- Flammability testing: Particularly important for sleepwear and costumes

- Certification costs: Third-party verification and documentation

According to Consumer Product Safety Commission requirements, children's sleepwear must undergo specific flammability testing that adds $150-300 per style, while general compliance testing typically costs $400-800 per style depending on fabric types and colors.

How can brands manage compliance costs effectively?

Strategic approaches to compliance costing:

- Batch testing: Group similar fabrics and colors to reduce test quantities

- Component standardization: Use pre-certified trims and materials across multiple styles

- Testing timing: Conduct compliance testing during development rather than production

- Documentation systems: Implement efficient tracking to avoid redundant testing

We help clients develop compliance calendars that schedule testing efficiently and identify opportunities for cost savings through smart material selection and component standardization. One brand reduced their compliance costs by 40% by strategically planning their color palette and fabric selections to minimize required testing.

How Do Logistics and Additional Expenses Impact Final Costs?

The journey from finished production to your warehouse involves multiple cost layers that can add 15-30% to your factory costs. These logistical and operational expenses often get overlooked in initial calculations but significantly impact your total investment.

Logistics costs begin the moment garments leave the production line and continue through shipping, customs, duties, and final delivery. Additionally, brands must account for operational expenses like import fees, insurance, quality assurance, and inventory carrying costs. These elements transform the "ex-factory" price into the true "landed cost" that determines your actual investment.

What logistics costs should be included in calculations?

Comprehensive logistics costing includes:

- International shipping: Ocean freight or air shipping, insurance, documentation

- Domestic logistics: Port fees, trucking, warehouse receiving

- Customs and duties: Import taxes, brokerage fees, customs clearance

- Inventory costs: Storage, handling, shrinkage, capital tie-up

- Payment fees: Bank charges, currency conversion, transaction costs

The World Bank's Logistics Performance Index provides valuable benchmarking data for international shipping costs. Our analysis shows that logistics typically add 18-25% to factory costs for US-bound shipments from China, with variations based on shipment size, speed, and seasonality.

How can you accurately calculate total landed cost?

Use this comprehensive formula:

Total Landed Cost =

(Factory Cost + Quality Control)

- (Shipping + Insurance + Documentation)

- (Duties + Taxes + Customs Brokerage)

- (Domestic Transportation + Warehousing)

- (Payment Processing + Currency Exchange)

- (Inventory Carrying Cost + Risk Margin)

We provide clients with a landed cost calculator that automatically updates with current shipping rates, duty percentages, and other variables. One brand discovered they were underestimating their true costs by 32% by only counting factory price and basic shipping - a miscalculation that was eroding their margins with every shipment.

Conclusion

Calculating the true cost of manufacturing kids clothing requires meticulous attention to direct materials, labor variations, factory overhead, compliance requirements, and logistical complexities. The brands that succeed in this competitive space aren't those who find the cheapest factory, but those who understand their complete cost structure and make informed decisions accordingly.

True cost understanding enables smarter design choices, accurate pricing strategies, and sustainable business growth. If you're looking to develop children's wear with complete cost transparency and strategic manufacturing partnerships, we can provide the detailed costing analysis and production expertise you need. Contact our Business Director, Elaine, to discuss how we can help you calculate and optimize your manufacturing costs. Reach her directly at elaine@fumaoclothing.com.